Creating a simple business valuation with multiples

Introduction – Why should I use multiples?

Price is the paramount issue in any M&A transaction. Beyond anything else, it determines the amount of value that is transferred from the buyer in exchange for ownership of the company. While there are several established methods to estimate the price range of a company, M&A professionals gravitate toward discounted-cash-flow (DCF) analysis as the most accurate and flexible method for valuing companies. A DCF analysis, however, is only as accurate as the forecasts it relies on. Errors in estimating key factors such as a company’s growth rate or its weighted average cost of capital can lead to a distorted picture of a company´s fair value.

The market approach is one of the most common approaches to valuate a company. It is based on the principle of substitution and the premise that a rational investor will not pay a higher amount for a company than he would pay for a company with similar characteristics and utilities. As a result, application of the market approach usually includes the use of market multiples, calculated for comparable companies that are listed on stock markets or that have recently been sold or purchased.

Among M&A professionals, multiples are already an accepted tool. Almost 85% of equity research reports and more than 50% of all acquisition valuations are based on multiples. This approach is frequently used to translate the results of a DCF analysis into intuitive figures, in combination with those acknowledged methods to back them up or as an alternative to estimate the value of a company in an easier and faster way.

Besides the fact that multiple valuations can be completed faster and with fewer assumptions than complex valuation approaches, multiple valuation brings additional advantages:

1. Multiples are easy to understand and therefore simple to present to clients.

2. Trading multiples are regularly published and updated by financial newspapers, magazines and online platforms.

3. M&A professionals frequently communicate their beliefs about the value of firms in terms of multiples within their research reports.

4. The screening on multiples allows quick comparisons between firms, industries, and markets.

5. Multiples reflect the current mood of the market, since their attempt is to measure relative and not intrinsic value.

What are multiples?

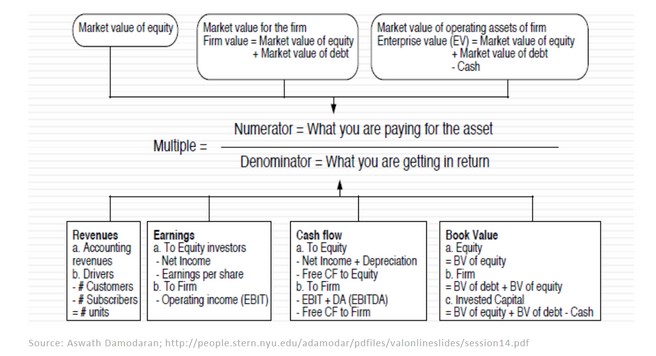

A valuation multiple is an expression of market value of an asset relative to a key variable that is assumed to relate to that value. Multiples are therefore just standardized estimates of price and are created by dividing a measure of the company’s value by a measure of the company’s performance:

How to do a business valuation with trading multiples!

1. Select comparable companies

The first step is to find comparable public companies. However, finding the right companies for the comparable set is challenging. Most analysts start by examining a company’s industry. A good way to do that is to use the Standard Industrial Classification (SIC) codes published by the US government. An alternative is to examine the key competitors of a company if they are listed in their annual report. Besides the same industry, the comparable companies should also offer similar products or services, be of similar size and should have a similar growth rate. You should also have in mind that it is almost impossible to find comparables that will match all of those criteria perfectly, but the goal is to find at least five companies that are a good comparison.

2. Choose the multiple

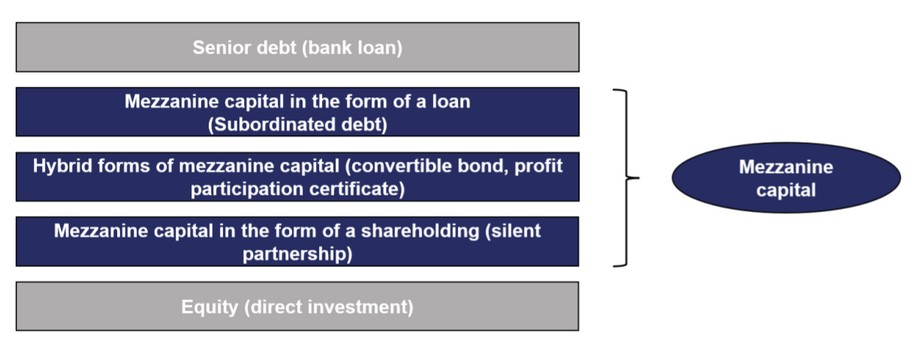

There are three types of multiples:

· Enterprise value multiples look at the whole capital structure of a company (debt and equity). The metric in the denominator must be a measure of the company’s performance that is available to all investors (equity investors and debt lenders). Common EV multiples include:

· EV / EBITDA

· EV / EBIT

· EV / Sales

· EV / Unlevered free cash flow

· Equity value multiples look merely at the equity portion of the capital structure. The metric in the denominator must be a measure of the company’s performance that is available to the shareholders only. Common equity value multiples include:

· Price / Earnings

· Price / Book Value

· Industry specific multiples provides measures of a company´s performance within a various industry. Some companies, like start-ups generate too less income in order to apply multiples that are based on EBITDA or sales. Nevertheless, those „rule of thumb“ – multiples should be used with caution as they are not a very accurate way of measuring the fair value of a company and represent a special case when valuing companies. Some examples of industry specific multiples include:

· Mobile network operators: EV / number of customers

· Hotels – EV / Number of beds

· E-commerce companies – EV / Clicks or Page impressions

Based on the company and its industry, certain multiples are preferred above others.

However, EBITDA is the most common metric used by buyers to assess the starting point for a valuation. EBITDA provides several advantages compared to other measures of a company’s performance:

· Takes the profitability into account

· Independent from capital structure

· Independent from company specific tax policy

· Internationally comparable due to the elimination of different depreciation & amortization accounting principles.

To calculate EBITDA, take the net income from the company’s financial statements. As the acronym suggests, add back interest, taxes, depreciation and amortization to calculate the company’s EBITDA. Some adjustments need to be made in order to normalize EBITDA – e.g.: One-time expenses or revenues, overly aggressive or conservative application of an accounting policy, etc.

3. Calculate the multiple

The next step is the calculation of the implied valuation multiple for each comparable company selected. To do that, the following variables are needed:

· Share price of the stock as at a current date;

· Outstanding number of shares for each company;

· Cash in the companies

· Outstanding long term debt

· EBITDA

With those data the enterprise value is determined as follows: Enterprise value (EV) = stock price x number of shares outstanding – cash + debt. Now the implied valuation multiple can be calculated simply by: Enterprise Value / EBITDA.

Those multiples need to be aggregated into a single figure using a central statistic, such as

the mean, the median, the harmonic mean or the geometric mean.

4. Apply and adjust

The comparable multiple from public companies can now be applied to the company’s normalized EBITDA to receive an estimate of the enterprise value.

The final step is to adjust the EV to even possible strengths and weaknesses. In some cases it is even necessary to discount the EV by 25% – 50% to account for the difference in a premium paid for larger companies. Good Judgment and experience are needed to select the appropriate discount to the enterprise value.

Final thoughts

Even though a thorough conducted discounted-cash-flow analysis delivers the most accurate „fair value“ of a company, multiples also merits a place in any M&A professionals valuation tool kit. Yet multiples are often misunderstood and, even more often, misapplied. Indeed, the ability to make right decisions in a multiple valuation like choosing appropriate comparables, selecting multiples that makes sense or even several adjustments to variables like EBITDA or the final enterprise value distinguishes sophisticated M&A veterans from newcomers.

Author:

Simon Fabsits, MSc

Dealbridge M&A Advisors Austria & Liechtenstein