How do M&A advisors create value?

When business owners decide it is time to sell their company, they have to answer the questions „Do I really need to hire an M&A advisors or does it make more sense to do it myself“? Although there are many benefits to hirings an advisor, some business owners still choose to bypass the intermediary, thinking the value is overstated. The point of this article is to discuss the overall value to a business owner of hiring someone to assist them in selling their company.

Do M&A advisors create value?

An independent study entitled „Does Hiring M&A Advisers Matter for Private Sellers?“ conducted by researchers from the University of Alabama examined the decision and the consequences of hiring sell-side M&A advisors. The study authors gathered and analyzed data from 3.8281 acquisitions of private firms and found out that 53% of private sellers do not use an M&A advisors. The results of the study definitely speak in favor of hiring an intermediary: sellers who retain an advisor receive an increased acquisition premium of 6 – 25% % more over a seller that attempts to sell the company on their own.

Going back to the initial question, it appears that M&A advisors create real value for a private seller. But how and where do they create value?

How do M&A advisors create value?

1. Expertise & Experience

When owners pursuing the sale of their business for the first time, a common challenge is that they do not know what they do not know. There are many steps in the process – from the business valuation to the preparation of the confidential business report (CBR) to the sourcing of buyers to negotiations and due diligence. An experienced M&A advisor has gone through those steps and processes over and over again and can therefore help owners to avoid common deal breakers, ask the right questions, ensuring a structured and well-planned process and finally execute a successful deal.

One very important document in the sales process of a business is the confidential business report (CBR). This document is shared with potential buyers and should educate the buyers about the company, excite them about the investment opportunity and move the transaction forward by providing buyers important information about the business. Professional advisors are experts on how to write the CBR and put the business for sale in a favorable light.

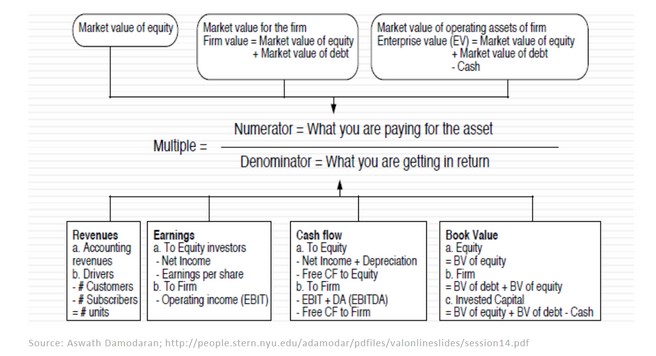

Another very crucial step in the sale of a business is an accurate valuation. Advisors provide the business valuation analysis which is needed by the seller to evaluate the reasonableness of a buyer´s potential offer. For instance, a seller may believe that the business is worth around €10 million, but based on an objective valuation, its M&A advisor may value it around €15 million, even before considering the value of synergies. Experienced advisors are specialists in the valuation of companies in accordance with international valuation methods which usually requires a lot of expertise and experience.

2. Bargaining Power

Private mid-market companies are less visible and receive less attention than publicly traded companies. This leads to fewer bids from investors. M&A advisors typically have the right business relationships, databases and the networks that they can utilize to identify financial and strategic buyers. A larger pool of potential buyers will result in a higher number of competing bids which creates a healthy competitive tension among buyers. Like supply and demand, a seller has more bargaining power when prospective buyers are competing with other bidders. An M&A advisor helps generating competition which will ultimately result in a higher acquisition premium for the business.

3. Credibility

A professional advisor also adds credibility to the sale of the business. Buyers know that the information provided to them are accurate, thorough and well-structured when an M&A advisor is involved. Professional investors often receive an enormous amount of investment opportunities, which they have to filter. Very often they will not even pursue an acquisition unless the business owner hires professional intermediaries. Professional buyers know from experience, that the whole sales process takes a significant amount of work and expertise. Dealing with M&A advisors gives them a strong feeling of confidence about the presented information, an efficient process of reviewing the opportunity and a higher chance of a successful closing.

4. Protection of the owners interest

Especially in the world of mid-market companies, the business is very often the „owners baby“. Selling can therefore be an emotional process. A professional advisor understands how to approach the business owners’ fears, answers questions and act as a middleman during negotiations with potential buyers. This is often crucial as direct negotiations between the parties can lead to a breakdown of the deal. Both sides will be under pressure at times and benefit from having a buffer that keeps the communication and the deal process on track. Experienced M&A advisors know how to handle investors during negotiations and know how to deal with tough and demanding buyers during due diligence.

Another important aspect is the protection of confidentiality. It is extremely difficult for a seller without a third-party advisor to go out to the entire market and keep their company sale confidential. M&A advisor know how to approach potential buyers without disclosing the identity of the seller. Every buyer should sign a non-disclosure agreement (NDA) before knowing anything about the company and its owner.

5. Reduction of workload

Most SMEs do not have a corporate development team. This means that those who are in charge of the sale of the company like the CEO, CFO or other executives, are also busy within their day jobs. However, the sale of a business requires an enormous amount of time and attention. If done without a third party advisor it would be inevitable that the responsible executives need to split their time between their daily tasks and the sales process. An M&A advisors can therefore augment a company’s internal resources.

Conclusion

The sale of the own company is likely to be the most important financial decision of a business owner. The primary reason sellers do not seek help from professional advisors is because of the perceived cost. However, when you look at the value provided by an M&A advisor during the sale process, that perception is proven inaccurate.

The study „Does Hiring M&A Advisers Matter for Private Sellers?“ provides empirical evidence that financial intermediaries improve M&A outcomes for private sellers, which are likely to lack deal-making experience and negotiating skills. Overall advisor-assisted private sellers receive an acquisition premium of 6–25% relative to their unassisted peers. Given the fact that mid-market advisors typically charge fees of 1-6% depending on the deal size, it is reasonable to conclude that experienced M&A advisors do add tangible value to a sales process.

Author:

Simon Fabsits, MSc

Dealbridge M&A Advisors Austria & Liechtenstein