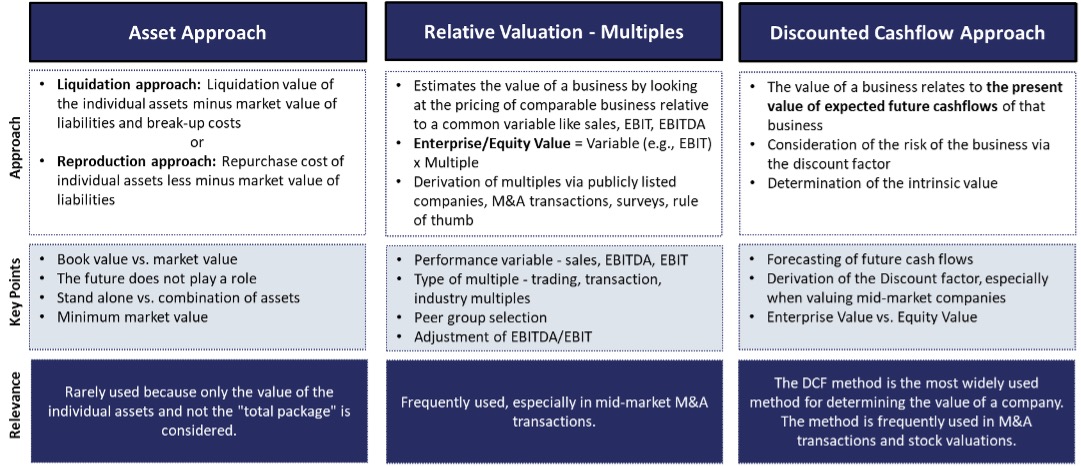

Among many investment bankers, M&A consultants, university professors and other financial professionals, the Discounted Cash Flow analysis is considered as the gold standard of business valuation. A DCF analysis is a very flexible and accurate way to evaluate a project, division or entire companies.

Any DCF analysis, however, is only as accurate as the assumptions and forecasts it relies on. Errors in estimating key value drivers can lead to a very distorted picture of a company´s fair price. Depending on the determination of the key value drivers, the enterprise value for the same company can differ greatly. Therefore, every DCF analysis has to focus on a careful determination and justification of those important parameters. This article is intended to give an overview of the key value drivers and discuss their influence on the enterprise value.

Free Cashflow projections

Since the cashflows usually have the strongest influence on the enterprise value, the projection of the free cashflows is the decisive aspect of every DCF analysis. The development of the cashflows depend on various value drivers such as sales growth, profit margin, investments in fixed assets (CAPEX) and investments in working capital. These value drivers will be discussed below.

1. Sales

Logically, if all other value drivers remain the same, higher sales lead to higher cash flows and thus to a higher enterprise value. However, the assumption that other factors will remain unchanged with higher sales is unrealistic and untenable. For example, an increase in sales usually also entails additional investments in working capital. If the company encounters its production capacities at certain sales levels, investments in fixed assets must also be taken into account. The effects of the change in sales can therefore not always be clearly determined at first glance.

When planning sales, it is advisable to take into account the development of the entire economy, the industry and of course, the company´s position in the market. This results in a much more valid forecast of the turnover figures than a simple linear continuation of the turnover growth rates of the past.

2. Profit Margin

In contrast to an increase in turnover, a reduction in costs always has a value-increasing effect. If the company succeeds in reducing costs (ceteris paribus assumption), the EBIT margin and thus also the free cashflows and the enterprise value will increase.

3. Working Capital and CAPEX

Even if sales remain unchanged, there may be changes in working capital. Thus, for example the payment modalities of the customers or also the own payment modalities can change. Higher payment terms of the customers lead to an increase in trade receivables and thus to an increase

in the working capital requirements. The opposite effect is caused by greater utilization of the company’s own payment terms.

Investments in fixed assets (CAPEX) can largely be derived from the schedule of fixed assets. If replacement investments in fixed assets were not made in the past, they must be made sooner or later. In this case the future investments in fixed assets increase in comparison with those in the closer past, even if the conversion remains constant. A further reason for increased investments can be technical innovations of the own machinery. All these factors must be taken into account when forecasting capital expenditures.

Cost of Capital – Discount factor

The effect of the costs of capital on the enterprise value is immediately apparent. If the return requirements for debt and equity, and thus the discount factor increase, the cashflows will be discounted with a higher factor which results in a lower enterprise value. Mathematically, this relationship is clear because the present value of the cash flows is directly dependent on the level of the discount factor and thus on the cost of capital.

The discount factor is influenced by the following parameters (if WACC approach is used):

1. Cost of debt: The cost of debt is usually determined by the following three factors:

· The risk-free interest rate: If the risk-free interest rate rises, the cost of borrowing also rises.

· The default risk or risk premium: If the default risk of the company being valued increases, the cost of borrowing also increases.

· tax effect: as the cost of debt capital (interest payments) is tax deductible (tax shield), the cost of debt capital is reduced.

2. Cost of equity: If the return requirements of equity investors increase, the enterprise value decreases. In a DCF analysis, the cost of equity is usually calculated using the Capital Asset Pricing Model (CAPM). The amount of the cost of equity depends on the factors of the risk-free interest rate, the market risk premium and the beta factor.

3. The capital structure: The cost of capital of the company and also depends on the capital structure. As a rule, financing with equity capital is more expensive from the company’s point of view than with borrowed capital. Debt capital providers receive fixed payments that are independent of the profit generated. Equity investors, however, demand a risk premium due to the uncertainty of the payments to which they are entitled.

Growth rate of the Terminal Value

The growth rate of the cashflow in the Terminal Value reflects the growth of the cashflow at the end of the detailed forecasting period. This growth rate is intended to reflect corporate growth to infinity. It therefore makes sense to use a variable such as general economic growth as the growth rate for the company. In practice, growth rates between 0 and 3% are used, whereby 3% is the upper limit and is only used for companies in extremely dynamic industries. An increase in the growth rate from 1% to 3%, for example, results in an enormous increase in the Terminal Value and thus also in the enterprise value.

Length of the Forecast period

Contrary to the widespread opinion that the length of the detailed forecasting period does not affect the present value and thus the enterprise value, a change in the enterprise value can very well be observed when extending or shortening the detailed forecasting period in the DCF analysis. The direction and the extent of the change of the enterprise value depends on the individual case.

Usually, the growth rate applied in the years of the detailed forecasting period is significantly higher than the growth rate in the Terminal Value. Many companies are also planning a continuous increase of the EBIT margin during the planning horizon. If the forecast period is extended, the Terminal Value is calculated based on a higher cashflow (cashflow of the last detailed planning period). This results in a higher Terminal Value and thus also in a higher enterprise value.

Conclusion

The analysis of the value drivers not only serves to sensitize the user to the most important parameters of a DCF analysis but is also helpful in decision-making. Whether an acquisition or sale is the right decision depends on the price of the company. In the DCF analysis, however, this fair price is determined on the basis of forecasted figures that are subject to uncertainty. Therefore, when determining an enterprise value, different scenarios should always be considered that reflect this uncertainty. It is therefore advisable to analyze the enterprise value with multiple variants of the key value drivers. Three scenarios should be considered and analyzed: a base case, which represents the most probable development, a best case, which represents a very positive development, and a worst case, which represents a negative development. For each of the resulting scenarios, the company value is determined so that a value range is obtained.

Author:

Simon Fabsits, MSc

Dealbridge M&A Advisors Austria & Liechtenstein